Crude oil prices and its correlations (Pt. 2)

Following previous article, in this one I am going to examine correlations among Crude Oil prices and Global Sovereign Bonds, other Commodities and Foreign Exchange. In this article you can also find all the references used in this part and in the previous one.

Global sovereign bonds

To determine whether crude oil is correlated to sovereign bonds, we have to scale back first and examine the correlation between crude oil and interest rates (interest rates are inversely correlated to bond prices ). Cologni and Manera (2008) results suggest that an unexpected oil price shock is followed by an increase in inflation rate and by a decline in output growth. Then, the connections with interest rates depends on which one between inflation rate and output growth central banks want to deal with. The response of some of them has been directed to reduce – through lower interest rates – the impact of the shock on output growth rate. In contrast, monetary authorities of most countries reacted by raising interest rates, suggesting a contractionary monetary policy directed to fight inflation. Then, considering the relation between interest rate and bond price, when the former decreases, the latter increases. More in general, as highlighted in a Bloomberg article it not only the relative increase or decrease of oil price that matters, but also its volatility: the yield on German 10-year bunds, Europe’s benchmark sovereign securities, has jumped almost 30 basis points in September 2015 reflecting the crude market’s volatility that saw Brent oil futures jump 26 percent in three days.

Commodities

Literature about commodities has confirmed many times the link between oil prices and other commodities, especially food commodities. In fact, energy impacts commodity production in some very important ways. For instance, the use of chemical and petroleum derived inputs has increased in agriculture over time. Harri, Hudson and Nalley (2009) found that commodity prices are linked to oil for corn, cotton, and soybeans, but not for wheat. Campiche et al. (2007) concluded from their analysis that soybean prices seemed to be more correlated (through the biodiesel market) to crude oil prices than corn prices. The historically strong positive correlation between oil and food prices has been confirmed even by CEIC , especially in recent years as food production is becoming more and more fuel-dependent. A thorough examination of either correlation or causation of the oil sector on commodity prices has been made by Saghaian (2010) that shows that although there is a strong correlation among oil and commodity prices, the evidence for a causal link from oil to commodity prices is mixed, since different tests of causality give different results. However, even this study shows that there is a strong correlation among oil and commodity prices and it speculates about the fact that a good reason for these correlations might be the fact that grains are directly linked with ethanol and oil markets through the oil–ethanol–corn linkages. Anyway, the main purpose of the present analysis is to find correlation, and from many studies it appears that there is a strong one between oil prices and agricultural commodities.

Foreign exchange

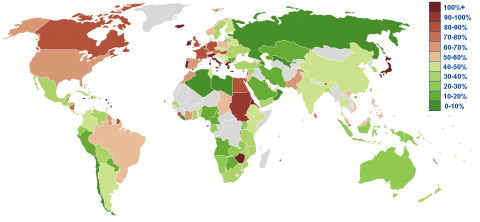

The potential importance of oil prices for exchange rate movements have been noted by McGuirk (1983), Krugman (1983a, 1983b), Golub (1983) and Rogoff (1991) and then are known by many years. Chen and Chen (2007) examined the ability of real oil prices to forecast future real exchange returns and their estimations suggest that real oil prices have significant forecasting power, in particular they found a greater predictability over longer horizons. Nikbakht, L., (2009) examined OPEC members exchange rates in depth and found that real oil prices may have been the dominant source of real exchange rate movements. Moreover, they found a long-run and positive linkage between real oil prices and real exchange rates for these countries. Aziz and Bakar (2011) found a positive and statistically significant impact of real oil price on real exchange rate for net oil importing countries, implying that increase in oil price leads to real exchange rate depreciation. However, differently from the previous paper, this one found no evidence of long run relationship between real oil price and real exchange rate in a panel that consists of net oil exporting countries.

To sum up, real oil prices have significant forecasting power over real exchange returns, in particular there exist a negative correlation between those two for net importing countries, and viceversa for net exporting ones (even if in this case some papers found a statistical significative correlation while others do not).

References

Faff, R., Nandha, M., 2008. “Does oil move equity prices? A global view“, Energy Economics, Volume 30, Issue 3, May 2008, Pages 986-997

Golub, S.S. (1983), “Oil Prices and Exchange Rates”, Economic Journal, No. 93, pp. 576-93.

Guesmi, K., Boubaker, H., Lai, Van Soi, 2016. “From Oil to Stock Markets”, Journal of Economic Integration 03/2016; 31(1):103-133.

Hamilton, J. D., 1983. “Oil and the Macroeconomy since World War II”. Journal of Political Economy, 91(2), 248. 16

Hamilton, J. D., 1996. “This is what happened to the oil price-macroeconomy relationship”. Journal of Monetary Economics, 38(2), 220.

Harri, A., Hudson, D., Nalley, L., 2009. “The Relationship between Oil, Exchange Rates, and Commodity Prices”, Journal of Agricultural and Applied Economics, 41,2 (August 2009):501–510

Hooker, M. A., 1996. “What happened to the oil price-macroeconomy relationship?” Journal of Monetary Economics, 38(2), 213.

Hooker, M. A., 2002. “Are Oil Shocks Inflationary? Asymmetric and Nonlinear Specifications versus Changes in Regime”. Journal of Money, Credit & Banking, 34(2), 540-561.

Kilian, L. and Park, C. (2009), “The impact of oil price shocks on the u.s. stock market”, International Economic Review, 50: 1267–1287.

Krugman, P. (1983a), Oil and the dollar In Economic Interdependence and Flexible Exchange Rates, Cambridge: MIT Press.

Krugman, P. (1983b), Oil shocks and exchange rate dynamics In Exchange Rates and International Macroeconomics, University of Chicago Press

Lee, K., & Ni, S., 1995. “Oil shocks and the macroeconomy: The role of price variability”. Energy Journal, 16(4).

McGuirk, A.K. (1983), “Oil price changes and real exchange rate movements among industrial countries”, International Monetary Fund Staff Papers, Vol. 30, pp. 843-83.

Miller J. I., Ratti R.A., 2009. Crude oil and stock markets: Stability, instability, and bubbles. Energy Economics 31, 559-568.

Mishkin, Frederic S. and Eakins, Stanley G. (2009). Financial markets & institutions (6th ed.). Boston, MA: Pearson.

Nikbakht, L., (2009). Oil Prices and Exchange Rates: The Case of OPEC, Business Intelligence Journal, 83-93.

Rogoff, K. (1991), “Oil, productivity, government spending and the real yendollar exchange rate”, Working Paper, Federal Reserve Bank of San Francisco, San Francisco, CA.

Rogoff, K. 2006. Oil and the global economy. Mimeo, Harvard University.

Rotemberg, J. J., & Woodford, M., 1996. “Imperfect Competition and the Effects of Energy Price Increases on Economic Activity”, Journal of Money, Credit & Banking, 28(4), 577.

Saghaian, S. H., 2010. “The Impact of the Oil Sector on Commodity Prices: Correlation or Causation?”, Journal of Agricultural and Applied Economics, 42,3 (August 2010):477–485

Saunders, Anthony and Cornett, Marcia Millon. (2009). Financial markets and institutions (4th ed.). New York, NY: McGraw Hill.

Related posts:

About Luca Patron

Ex Studente di Finanza presso la Warwick Business School, ora lavora nel settore assicurativo in UK. Appassionato di politica ed economia, in passato ha militato tra le file del PD come Civatiano.

Related posts

About Luca Patron

Ex Studente di Finanza presso la Warwick Business School, ora lavora nel settore assicurativo in UK. Appassionato di politica ed economia, in passato ha militato tra le file del PD come Civatiano.